Bitcoin Adoption in Africa: The Quiet Financial Revolution

Balogun Malik

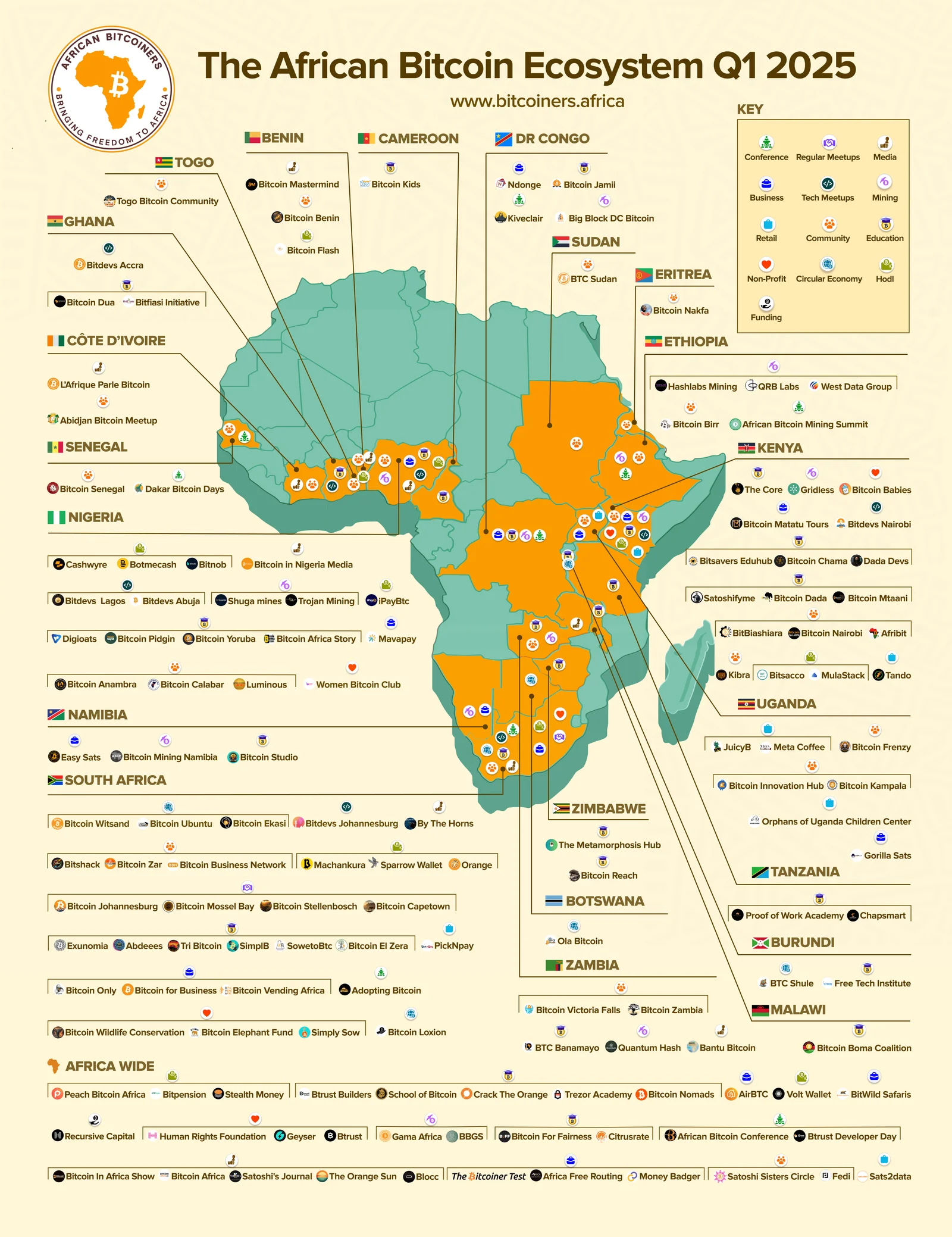

When people talk about Bitcoin adoption, they often focus on big players like the U.S., Europe, or China. But there's one region quietly leading a financial revolution: Africa. Bitcoin adoption on the continent is skyrocketing, not as a trendy investment but as a real, practical solution to deep-rooted financial issues.

Why Bitcoin? Why Africa?

Africa is a continent of contrasts. It has some of the fastest-growing economies in the world, yet many of its people remain unbanked or underbanked. Traditional financial systems are often unreliable and plagued by high fees, corruption, and government restrictions. In many African countries, inflation is a nightmare, with local currencies losing value at an alarming rate. Enter Bitcoin—an alternative that doesn’t require trust in a central authority, can be accessed with a smartphone, and offers financial freedom like never before.

The Problems Bitcoin Solves in Africa

1. Banking the Unbanked

Millions of Africans lack access to traditional banking. In some parts of Africa, setting up a bank account can be expensive, require unnecessary paperwork, or even be impossible. But with Bitcoin, all you need is a smartphone and an internet connection. Peer-to-peer (P2P) Bitcoin trading platforms allow users to send and receive money without a bank, opening doors to financial inclusion for millions.

2. Fighting Inflation

Countries like Zimbabwe and Nigeria have experienced hyperinflation that has wiped out savings and destroyed purchasing power. Bitcoin, with its limited supply of 21 million coins, offers an alternative store of value. Instead of watching their money lose value overnight, many Africans are turning to Bitcoin as a hedge against inflation.

3. Cheaper and Faster Remittances

Remittances from the African diaspora are a lifeline for many families. However, traditional remittance services like Western Union charge high fees and can take days to process transactions. Bitcoin drastically reduces these costs, allowing Africans to receive money almost instantly with minimal fees.

4. Circumventing Government Restrictions

Several African governments have imposed strict capital controls, making it difficult for people to access foreign currencies or move money freely. In Nigeria, for example, the government has cracked down on cryptocurrency exchanges, yet Bitcoin transactions have only increased. P2P trading allows people to bypass these restrictions and retain control over their own money.

The Growth of Bitcoin in Africa

Despite government crackdowns in some regions, Bitcoin adoption continues to grow across the continent.

Nigeria: Africa’s Bitcoin Powerhouse

Nigeria consistently ranks as one of the top countries in the world for Bitcoin trading volume. High inflation, a struggling economy, and restrictive banking policies have made Bitcoin incredibly popular among young Nigerians who see it as a path to financial independence. P2P platforms like Bybit, Noones, IpayBTC, and Binance P2P are thriving despite government resistance.

Kenya: The Crypto Hub of East Africa

Thanks to mobile money systems like M-Pesa, Kenya has long been a leader in digital finance. It’s no surprise that Bitcoin has found a strong foothold here. Many Kenyans use Bitcoin for remittances, as a savings tool, and as a freedom tool. The country is also home to a few Bitcoin innovations, such as Tando, Bitcoin Dada, KibraBTC, etc.

South Africa: Institutional Interest Rising

South Africa has a more developed financial system, but Bitcoin adoption is still on the rise. Businesses are starting to accept Bitcoin payments, and institutions are showing increased interest in blockchain technology. South Africans are also using Bitcoin as an investment, viewing it as "digital gold."

The Challenges Facing Bitcoin Adoption in Africa

Of course, Bitcoin adoption in Africa isn’t without its challenges.

1. Internet and Electricity Access

Many African countries still struggle with inconsistent internet and electricity, which makes Bitcoin transactions difficult. However, companies like Machankura, improvements in mobile internet, and the growing use of solar-powered tech solutions are helping bridge this gap.

2. Government Crackdowns

Some African governments see Bitcoin as a threat to their control over the financial system. Nigeria, for instance, banned banks from facilitating crypto transactions. However, this hasn’t stopped adoption; it has just pushed people to use P2P networks.

3. Education and Awareness

Bitcoin is still a new concept for many, and misinformation is rampant. Some people associate Bitcoin with scams or view it as too complex. Increasing awareness and education about how Bitcoin works is crucial for further adoption, and Bitcoin Companies like Btrust Africa, Citrusrate, Digioats, African Bitcoiners, Bitcoin Dada, etc. are contributing massively to Bitcoin education and increasing its awareness

The Future of Bitcoin in Africa

Despite the challenges, the future of Bitcoin in Africa looks incredibly promising. As more people turn to digital finance and as traditional banking continues to fail many Africans, Bitcoin will likely become even more integrated into daily life. Governments may resist at first, but they will eventually have to adapt, just as they did with mobile money.

We’re witnessing a financial revolution, one where Africans are taking control of their own wealth and financial destiny. Bitcoin isn’t just a speculative asset here—it’s a tool for economic empowerment, a hedge against uncertainty, a means of creating a more inclusive financial future, and a freedom tool.

Bitcoin in Africa isn’t just a trend. It’s a movement.